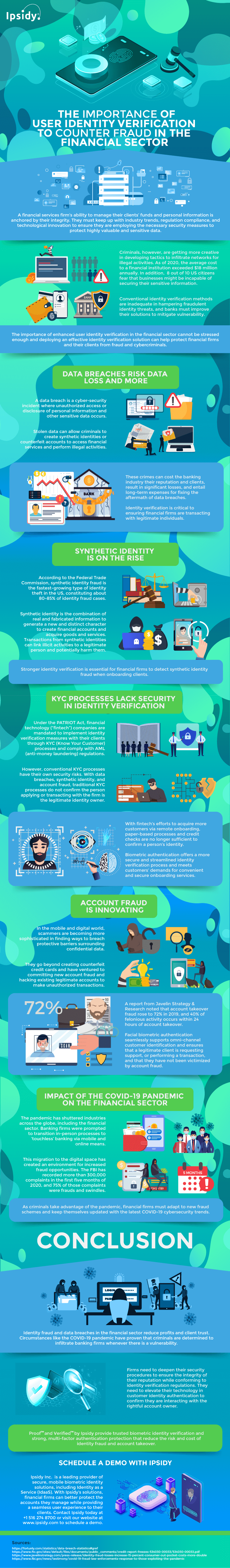

Monetary gain is often the motivation behind criminals’ fraudulent activities, with data breaches, identity thefts, and account fraud continuing to challenge financial firms. As of 2020, the average annual cost to a financial institution exceeded $18 million. Furthermore, 8 out of 10 Americans fear that companies might be incapable of securing their confidential information.

Therefore, to ensure the security of the information and funds entrusted to financial institutions, they must deploy verification processes when onboarding clients and authorizing transactions. These steps are necessary to protect organizations and their clients from fraud and cybercriminals.

Identity verification processes are not new in the banking sector. Financial firms must implement identity proofing to ensure regulatory compliance and counter illegal activities of criminals trying to intrude on their systems. However, with the continuous innovation of technology, conventional identity verification methods are inadequate in hampering fraudulent identity threats. Criminals are getting more creative in developing tactics to infiltrate financial systems. They often try to find vulnerabilities in the system to evade identity verification methods for their illegal acts.

Banking institutions need to keep up with market developments, technological innovation, and compliance with regulations to assure their clients that they can protect highly valuable and sensitive information entrusted to them. Many companies use biometric identification or two-factor authentication solutions to prevent unauthorized individuals from accessing their services.

As many people are now turning to electronic banking due to the coronavirus pandemic, the Federal Financial Institutions Examination Council (FFEIC) suggests that financial firms use multi-factor authentication solutions. The multi-factor verification process involves the use of two or more of the following authentication criteria:

- Something you have (token or smart card).

- Something you know (password or PIN).

- Something you are (biometrics).

Identity as a Service (IDaaS) solutions are offered by firms like Ipsidy to help businesses keep their companies secure, provide seamless user experience to their customers, and allow users to more secure access to sensitive data. This type of solution will also assist businesses in complying with laws like the Patriot Act and regulations, such as the Anti-Money Laundering (AML) and Know Your Customer (KYC).

Businesses in the financial sector know the value of user identity verification in strengthening consumer trust and improving their reputation. Implementing an effective identity verification solution is necessary to confirm that the customer they are interacting with is the rightful account owner. This infographic from Ipsidy provides more details on the significance of using trusted user identity verification methods to counter fraud in the financial sector.